FP&A Interview Questions

Real examples of the most common questions (and answers) used to hire for financial planning and analysis (FP&A)

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What are the Most Common FP&A Interview Questions?

Based on extensive research and feedback from professionals in Financial Planning and Analysis, we’ve compiled the most likely interview questions to be asked by an FP&A hiring manager. In addition, we’ve also created what we think are the best answers to these FP&A interview questions.

Please read through all these questions carefully and notice the themes. While you are unlikely to be asked the exact questions listed here, understanding the line of reasoning and types of questions typically asked should help you prepare answers to the commonly asked questions.

FP&A Interview Questions, with Answers:

Walk me through the three financial statements.

The balance sheet shows a company’s assets, liabilities, and shareholders’ equity, and is a snapshot in time. The income statement outlines the company’s revenues and expenses over a period of time (quarter/year). The cash flow statement shows the cash flows from operating, investing, and financing activities over a period of time. The three financial statements all fit together to show a picture of the company’s financial health.

How does an inventory write-down affect the three statements?

This can be one of the more challenging FP&A interview questions. Here is the answer: On the balance sheet, the asset account of inventory is reduced by the amount of the write-down, and so is shareholders’ equity. The income statement is hit with an expense in either COGS or a separate line item for the amount of the write-down, reducing net income. On the cash flow statement, the write-down is added back to Cash from Operations, as it’s a non-cash expense, but must not be double-counted in the changes of non-cash working capital.

How do you record PP&E and why is this important?

There are essentially four areas to consider when accounting for PP&E on the balance sheet: initial purchase, depreciation, additions (capital expenditures), and dispositions. In addition to these four, you may also have to consider revaluation. For many businesses, PP&E is the main capital asset that generates revenue, profitability, and cash flow.

If you were CFO of our company, what would keep you up at night?

Step back and give a high-level overview of the company’s current financial position, or companies in that industry in general. Highlight something on each of the three statements. Income statement: growth, margins, profitability. Balance sheet: liquidity, capital assets, credit metrics, liquidity ratios. Cash flow statement: short-term and long-term cash flow profile, any need to raise money or return capital to shareholders. Whatever your answer to this question, just remember, the main job of the CFO is managing the company’s liquidity in an optimal way, and earning a rate of return in excess of the company’s cost of capital (WACC).

What does it take to be a great FP&A analyst?

We believe there are three important qualities: analytics, presentation, and soft skills. Check out our guide on the Analyst Trifecta for a detailed breakdown of these three skills so you can ace this question if it comes up in the interview.

Name three challenges facing our company.

Same as the above question. If asked both questions, pick different points and add some high-level macro issues such as competition, interest rates, currency and foreign exchange, access to capital, etc. A well-thought-out answer will address both internal and external challenges.

What are the hallmarks of a good FP&A financial model?

First off, explain the main objectives of the FP&A department: measuring historical performance, evaluating future business needs, highlighting issues and strengths in the business, clearly communicating the most relevant financial information to management, instilling confidence in the quality of information presented. A good financial model must address all of these and be simple enough for anyone to understand, yet complex enough to handle all of the necessary detail of the business.

What’s the difference between budgeting and forecasting?

Budgeting is setting a plan for the future while forecasting is creating an estimate of what will actually happen. Budgeting is a collaborative process, typically set once per year, and is static (unless it’s a rolling budget). A forecast is based on incoming data and sets the most probable expectation of what will transpire, and is typically updated once a quarter.

How do you create a rolling budget or forecast model?

If it’s a monthly rolling forecast, you input the historical data that comes in each month at the front of the model and extend a forecast out beyond that. When you need to add a new month to the forecast, it should be at the end of the model. The model “rolls over” every month (or whatever time period is used) by extending the model out one column. The same approach can be applied to a quarterly forecast model.

How do you model revenues for a company?

This is one of the most common FP&A interview questions. There are three common ways to forecast revenues: bottom-up, top-down, and year-over-year.

- A bottom-up approach to financial modeling involves starting with individual products/services, estimating average prices/fees per product or service and then growth rates.

- A top-down approach involves starting with the overall market size, estimating a company’s market share, and then translating that into revenue.

- A year-over-year approach involves taking last year’s revenue and increasing it or decreasing it by a certain percentage.

How do you model operating expenses for a company?

You can do a bottom-up build, however, typically, operating expenses move in line with revenues. As a result, many models forecast operating expenses as a percent of revenues. It’s important to separate fixed and variable costs and model them appropriately. Fixed costs should only change in steps (as required), whereas variable costs will be a direct function of revenue.

How do you model working capital for a company?

There are three core components of working capital – accounts receivable, inventories, and accounts payable. These items are usually modeled to match what is happening with revenues and cost of sales by using “turns” or “days” ratios (e.g., inventory turns or inventory days). For example, you could look at the historic relationship between revenues and accounts receivable by calculating receivable days. Next, you would forecast receivable days – linking it to forecast revenues.

What are the hallmarks of a good Excel model?

It’s important to have strong financial modeling fundamentals. Wherever possible, model assumptions (inputs) should be in one place and distinctly colored (bank models typically use blue font for model inputs). Good Excel models also make it easy for users to understand how inputs are translated into outputs. Good Excel models include error checks to ensure the model is working correctly (e.g., the balance sheet balances, the cash flow calculations are correct, etc.).

What makes a “good” budget?

This is one of the somewhat subjective FP&A interview questions. In our opinion, a good budget is one that has buy-in from all departments in the company (if possible), is realistic, yet strives for achievement, has been risk-adjusted to allow for a margin of error, and is tied into the company’s overall strategic plan.

Additional Resources

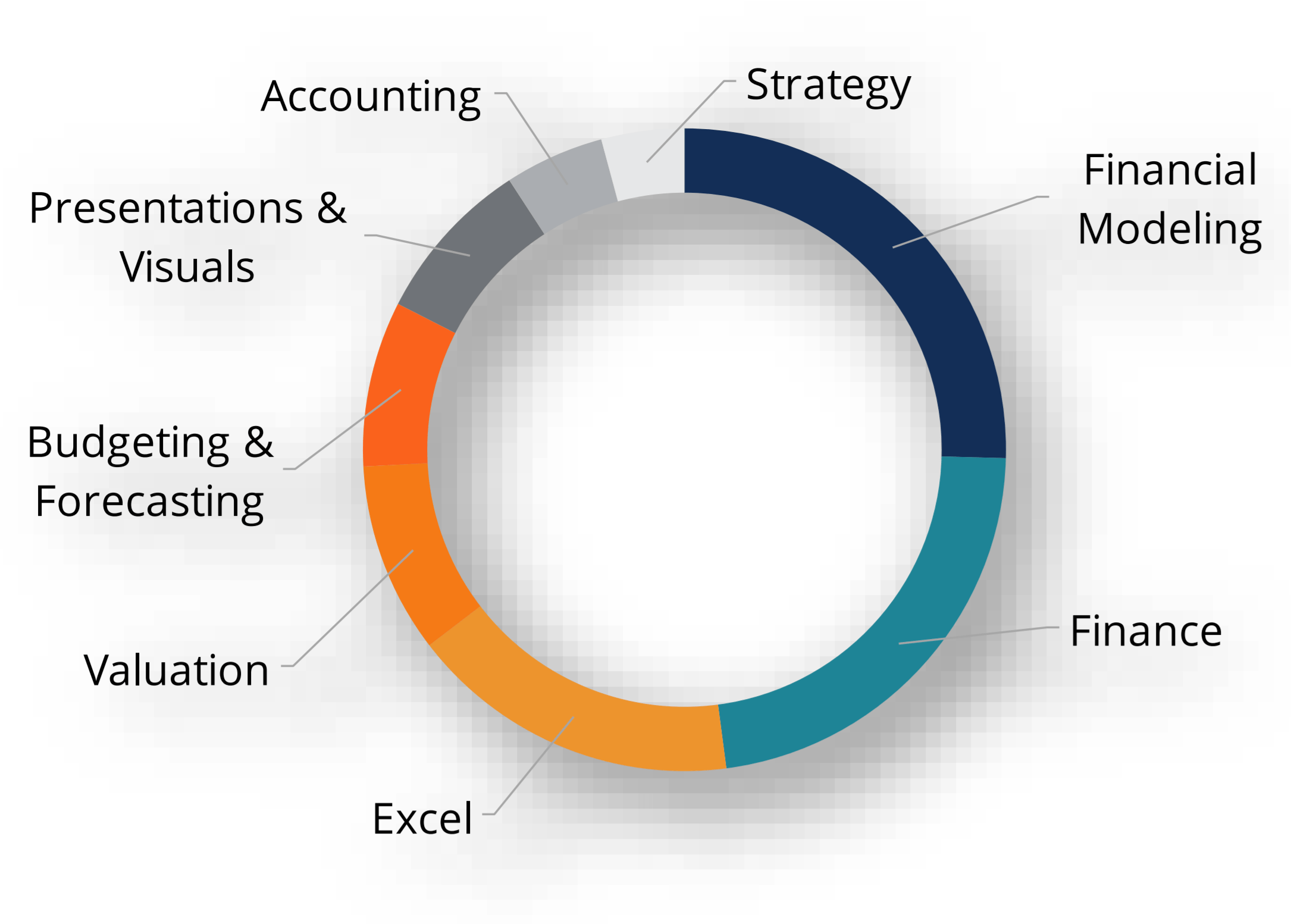

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in